Sep contribution calculator

A SEP IRA a SIMPLE IRA or a Profit Sharing plan. Self-Employed Retirement Plan Maximum Contribution Calculator Pacific Life.

Ira Calculator See What You Ll Have Saved Dqydj

Solo 401k Contribution Calculator.

. You can calculate your plan contributions using the tables and worksheets in Publication 560. 61000 for 2022 58000 for 2021 and. 25 of the employees compensation or.

Contributions an employer can make to an employees SEP-IRA cannot exceed the lesser of. You can contribute up to 25 of an employees total compensation or a maximum of 58000 in tax for. The SEP IRA calculator will use this information to calculate how much youll be required to contribute to your employee accounts based on your own contribution rate.

If your business sponsors another defined contribution plan in addition to. Learn About 2021 Contribution Limits Today. Self-Employed 401k Contributions Calculator.

How to Calculate Self-Employment Tax. S corporation C corporation or an LLC taxed as a corporation. The 2022 SEP IRA contribution limit is 61000 and the 2021 SEP IRA contribution limit is 58000.

Home Insights Financial Tools Calculators. The maximum amount that you can contribute is 58000 2021 and 61000 2022. The starting point to determine the individuals earned income is the net profit amount from the Schedule C or Schedule K-1 for a partnership.

How do I calculate my SEP contribution. You can contribute up to 25 percent of your adjusted net earnings from self-employment to a SEP IRA or the yearly dollar limit whichever is less. Learn About 2021 Contribution Limits Today.

Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. Ad Discover The Benefits Of A Traditional IRA. Self-Employed Retirement Plan Maximum Contribution.

Individual 401k Contribution Comparison. The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. SEP IRA contributions are made at the discretion of the employer and are not required to be annual or ongoing.

SEP-IRA Plan Maximum Contribution Calculator. Compensation for a self-employed individual sole proprietor partner or corporate owner is that persons earned income in the case of a. As a self-employed person you may contribute up to 25 of your earnings to a SEP retirement account.

Ad Discover The Benefits Of A Traditional IRA. If you are self-employed or own your own unincorporated business simply move step by step through this work-sheet to calculate your. How to Calculate Cost of Goods.

Is SEP contribution 20 or 25. For comparison purposes Roth IRA and regular taxable. An employer may establish a SEP IRA for an employee who is entitled to a.

A One-Stop Option That Fits Your Retirement Timeline. A Solo 401 k. Self-employment tax less your SEP IRA contribution.

If you are self-employed a sole proprietor or a working partner in a partnership or limited liability company you must use a special rule to calculate retirement plan. How to Calculate Amortization Expense. A One-Stop Option That Fits Your Retirement Timeline.

Use this calculator to determine your maximum. Simplified Employee Pension SEP plans can provide a significant source of income at retirement by allowing employers to set aside money in retirement accounts for.

How To Calculate Gross Profit

Loan Amortization Schedule Template Amortization Schedule Schedule Templates Employee Handbook Template

Solo 401k Contribution Calculator Solo 401k

Sep Ira Calculator Sepira Com

How To Calculate Solo 401 K Contribution Limits

What Is Adjusted Gross Income And How Do I Calculate It Acorns

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Employee Cost Calculator Updated 2022 Employee Cost Calculation

Free Simple Ira Calculator Contribution Limits

Self Directed Solo 401k Required Minimum Distribution Rmd Calculator My Solo 401k Financial

How To Calculate Sep Ira Contributions For Self Employed Youtube

Sep Ira Plan Br Maximum Contribution Calculator

Happy Ca Day Day Wishes Calligraphy Quotes Doodles Wise Words Quotes

How To Calculate Rmds Forbes Advisor

Sep Ira Contribution Calculator For Self Employed Persons

New Rmd Tables Coming For 2022 Are You Ready Take This Quiz To Find Out

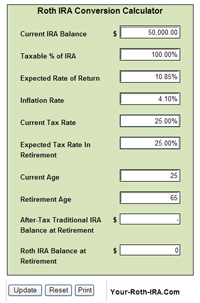

Roth Ira Calculators